UPDATE – June 26 2020: US Bankruptcy Court, District of Delaware, Approves Sale to Capitol Peak and KKR

Engles, (Capitol Peak, Previous Dean CEO) partners with KKR & Co. for Successful Bid

Borden Dairy, and its beloved icon, Elsie, have new owners.

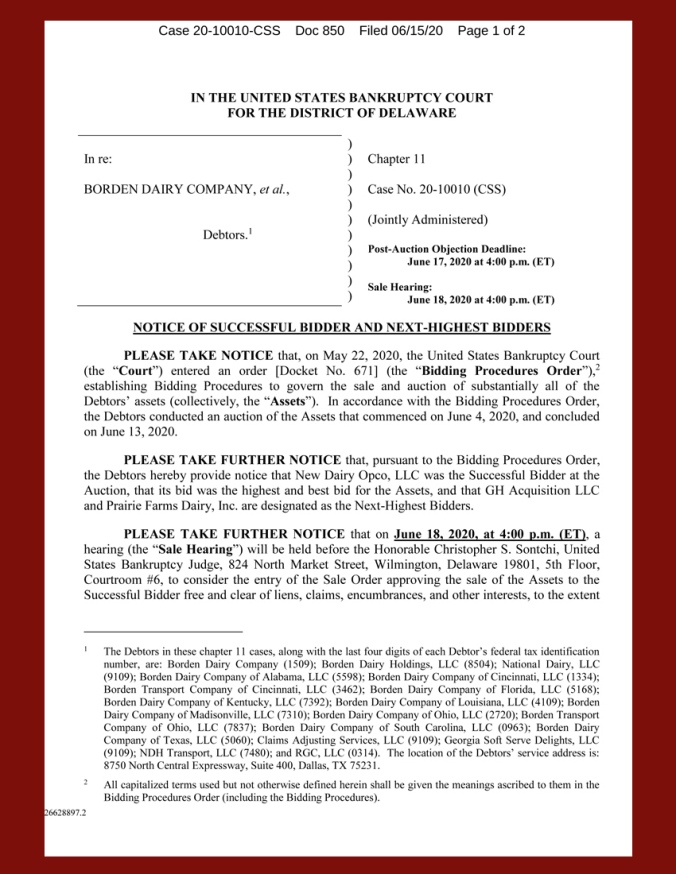

Early on the afternoon of June 15, 2020, New Dairy Opco, LLC, was announced as the winning bidder for Borden Dairy Company and its assets, 5 months after Chapter 11 was filed on January 5, 2020. A notice was posted on the website filing the Borden Chapter 11 Documents for the US Bankruptcy Court of Delaware, and is included below.

A Sale Hearing has been scheduled for Thursday, June 18, 2020 by the Bankruptcy Court. A series of hearings and court activity, dictated by Rules of Federal Court, will take place in the following weeks before a sale is final.

New Dairy Opco, LLC, is an entity comprised of KKR and Co., a US-based global investment firm, and Capitol Peak Partners, founded by Gregg Engles, a previous Dean Foods CEO. A Declaration entered on the Court’s docket on June 20, Docket #879, lists that Colin Murphy is the secretary of New Dairy Opco, which is commonly referred to as New Dairy.

GH Acquisition, LLC, and Prairie Farms Dairy, LLC, were announced as the next highest bidders.

This is a breaking news story, and more details will emerge going forward.

This change in ownership will set a new stage for dairy co-ops and independent dairy farms selling milk to the Borden plants, and hopefully provide more certainty to farmers of markets going forward.

The Sale Notice as it appeared on the Court’s Docket:

New Dairy Opco, LLC, became official as a Delaware corporation on June 1, 2020.

According to a Bloomberg report by Jeremy Hill and Isis Almeida, which doesn’t name sources, New Dairy Opco, LLC, is a joint effort of Capitol Peak Partners, headed by Gregg Engles (a previous CEO of Dean Foods), and KKR, said to be the world’s 2nd largest private equity firm. KKR had been prominently mentioned in the Borden bidding per the filings on the court docket.

In the late stages of the Dean Foods Chapter 11 process, KKR and Borden, along with some other financial entities, offered an alternative plan to the sale of Dean Foods to Dairy Farmers of America (DFA).

The Bloomberg story in its entirety, as first published at 2:20 pm on June 15th (the story has since been updated – see link above):

Background & Additional Resources:

General: Borden Fact Sheet – Summary: Borden has 12 plants, 91 branches, has 3,300 employees. The plants operate mostly in the southeast, somewhat in a crescent from Charleston, SC to Florida to Texas. The Fact Sheet also lists plants in Cleveland, OH, and London, KY.

17 June 2020, 2:30 pm: KKR, Former Dean Foods CEO win bid to buy Borden Dairy Co. in Bankruptcy Court; by Colleen Kotke for the Wisconsin State Farmer,

15 June 2020, 6:01 pm: Capitol Peak Partners, KKR Win Bankruptcy Auction for Borden, posted at Morningstar, provided by Dow Jones

15 June 2020, 6:29 pm: KKR, Former Dean Foods CEO win Auction for Borden Dairy Five Months After Bankruptcy Filing, by Natalie Walters for the Dallas Morning News

26 May 2020, 7:00 am: For a Second Time in Borden’s 163-year History, A Government Contract Could Propel it Through Crisis, by Natalie Walters, for the Dallas Morning News

Look for new developments as the story evolves.